US residential PV installer Vivint Solar expects installations to be flat through the second-half of 2016, while it recovers from the failed merger with bankrupt, SunEdison and introduces higher prices and selection criteria on rooftop solar projects.

Management noted in an earnings call with financial analysts that it would take several more quarters to return to ‘sustainable’ growth after the SunEdison merger failure and the introduction of new strategies that include better selection of projects that maximise returns and higher prices in around half of its served markets, inline with other competitors could limit growth.

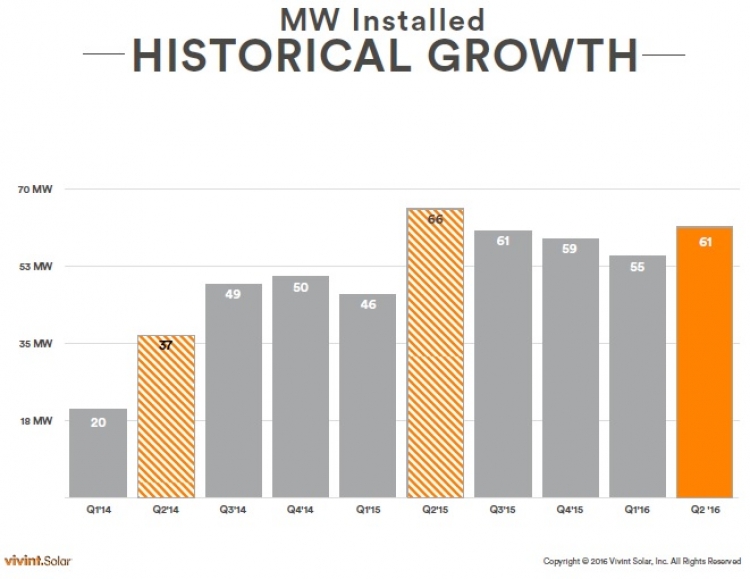

Vivint Solar reported second quarter total revenue of US$34.9 million, up 116% from US$16.1 million in prior year period on installations of 61MW, down 6% year-over-year. Cumulative installations reached 575MW with contracted payments reaching around US$2.3 billion, up 56% year-over-year.

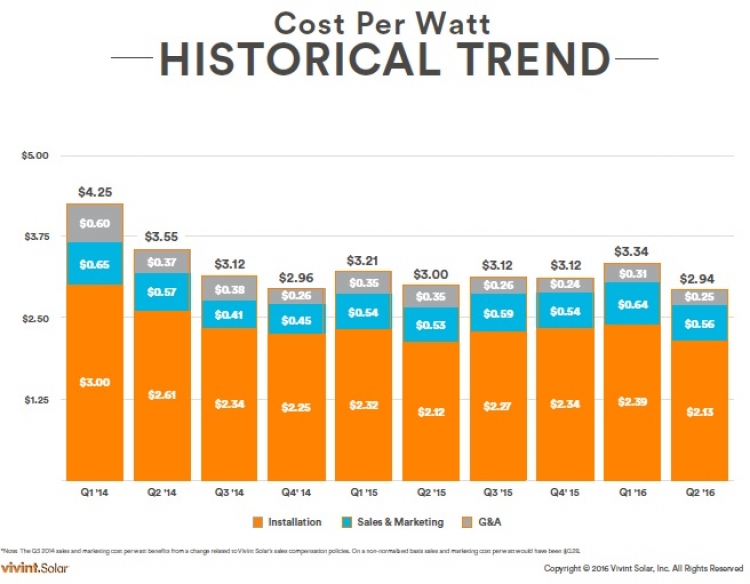

Installations in the quarter were 8,641, down 7% year-over-year, while cumulative installations reached 84,872. The company reported a cost per-watt of US$2.94, down from US$3.34 in the first quarter of 2016, and down from us$3.00 in the second quarter of 2015.

The company did not provide installation guidance for the third quarter and noted that it did not expect to meet previous full-year installation guidance of 260MW.

Loss from operations was US$36.5 million compared to US$72.3 million in the same period of 2015.

The company also noted that its new cash and loan sales were trending upwards as traditional lease market is changing with customers choosing better financing deals.

The company did not provide installation guidance for the third quarter and noted that it did not expect to meet previous full-year installation guidance of 260MW.

The company reported a cost per-watt of US$2.94, down from US$3.34 in the first quarter of 2016, and down from us$3.00 in the second quarter of 2015.